- January 26, 2017

- 12:14 pm

- Fady Harfoush

- no comments

Market Analysis and Outlook for 2017

About RIF:

The Rambler Investments Fund is a well-established fund that works primarily in the Business Analytics Lab. The Fund began in 2015 when the university allocated a portion of the university’s endowment funds for the student managed investment fund under the guidance of Professor Todd. Currently RIF is invested in a wide range of equities, fixed income and alternative assets. RIF strives for excellence and all of its members are “determined by commitment, show great work performance and interest.” The lab and RIF encourages those to join with an interest in valuing stocks and bonds, analyzing commodities and alternative investments, interpreting asset correlation and understanding the changing domestic and global economy. By joining RIF students will stand out in the competitive market because they will learn valuable skills required by the industry.

Outlook for 2017:

Every six months RIF reassesses and rebalances the portfolio due to the changing economy and then pitches it to the Investments Committee as well as the university officials. RIF projects that the new administration will drastically effect the stance on inflation, equity markets and the global economy. The past elections has swayed opinions on analysts and policymakers all over the world but those in RIF still “believe that the valuations of several particular companies are accurate and grown outlook in the mid to long term is still strong.” (For more information click the link below)

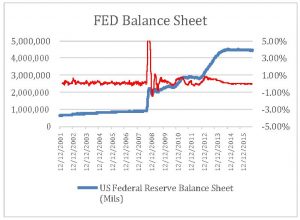

FED – With Donald Trump’s proposed policies of heavy government stimulus and lower taxation, the probability of subsequent rate hikes increases as the economy picks up momentum. These sentiments have been over-exaggerated in the short term as the US economy teeters along on sub-optimal fundamentals. As a result, we believe that US 10yr treasuries are oversold and reflect investor panic due to the unprecedented outcome of the election.

FED – With Donald Trump’s proposed policies of heavy government stimulus and lower taxation, the probability of subsequent rate hikes increases as the economy picks up momentum. These sentiments have been over-exaggerated in the short term as the US economy teeters along on sub-optimal fundamentals. As a result, we believe that US 10yr treasuries are oversold and reflect investor panic due to the unprecedented outcome of the election.